Chavis Capital

Investment Fund

Value Add Fund

Welcome to the Chavis Capital Value-Add fund. In an effort to continue our focus on capital preservation and further mitigate risk while still having upside potential, we created this fund. We have provided the information on this page to help you learn more about it and once you’re ready to invest, please click the button below to get started.

Investment Approach

Welcome to the Chavis Capital Value-Add fund. In an effort to continue our focus on capital preservation and further mitigate risk while still having upside potential, we created this fund. We have provided the information on this page to help you learn more about it and once you’re ready to invest, please click the button below to get started.

5-7 Properties

Target Properties

5-7 Years

ANTICIPATED LIFE OF FUND

$25,000

MINIMUM INVESTMENT

Investment Criteria

Communities located in Southeastern growth markets (specifically Atlanta, Jacksonville, Orlando, and Tampa)

CLASS A/B PROPERTIES WITH EXCELLENT OPPORTUNITY FOR VALUE CREATION THROUGH IMPROVEMENTS

UNDERPERFORMING OR DISTRESSED MULTIFAMILY PROPERTIES

200+ UNIT ASSETS IN HIGHLY DESIRABLE SUBMARKETS

$20 MILLION TO $100 MILLION TOTAL CAPITALIZATION PER PROPERTY

INTERESTED IN LEARNING MORE?

HERE ARE SOME ANSWERS TO FREQUENTLY ASKED QUESTIONS.

Targeted Fund Returns*

Cash on Cash Returns

(Avg including sale)

17%

Cash on Cash Returns

(Avg excluding sale)

6-9%

Levered IRR (Net)

13%-18

Equity Multiple (Net)

1.7x-2.0x

*Based on 5 year hold for Class B Limited Partner Investment. Target returns represent ranges for base case, downside, and upside scenarios.

**Projected cash on cash returns are based on base case assumptions for the properties within the Fund Note: Projected returns are based on LP levels of Fund

Annual Cash on Cash Projections**

Year 1:

5.60%

Year 2:

8.00%

Year 3:

9.00%

Year 4:

9.50%

Year 5:

10.00%

Why Invest In The Sunbelt?

Certain markets throughout the broader Sun Belt region are areas where the Fund Managers have significant market operating history and expertise and, therefore, offer similar opportunities.

Multifamily investment in the Sunbelt markets has proven successful throughout various real estate cycles, and our business model in particular will continue to produce a great risk-adjusted return ratio and deliver outsized returns for our investors.

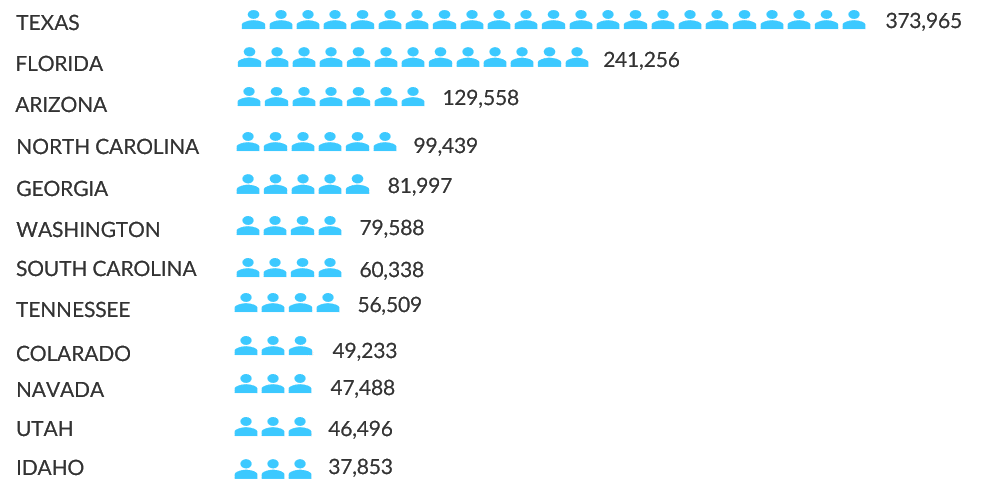

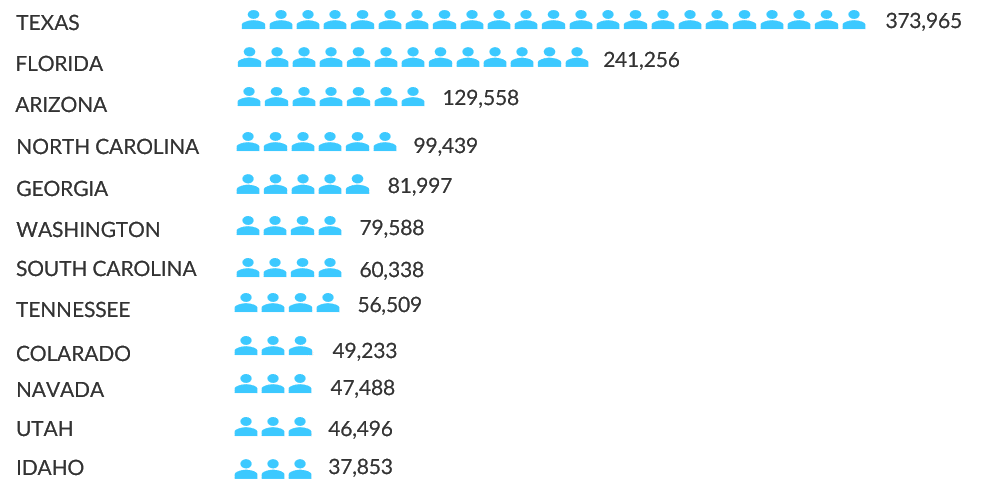

STATES WITH BIGGEST POPULATION NOMINAL INCREASES

Source: U.S. Census Bureau

Why Invest In The Sunbelt?

Certain markets throughout the broader Sun Belt region are areas where the Fund Managers have significant market operating history and expertise and, therefore, offer similar opportunities.

Multifamily investment in the Sunbelt markets has proven successful throughout various real estate cycles, and our business model in particular will continue to produce a great risk-adjusted return ratio and deliver outsized returns for our investors.

STATES WITH BIGGEST POPULATION NOMINAL INCREASES

Source: U.S. Census Bureau

UNDERSTANDING THE

Benefits of Investing in a Fund

- Spreads out investor equity over multiple acquisitions

- Greater exposure to investments in various markets and asset classes

- Ability to invest in different individual property business plans and hold periods

- Provides the opportunity to participate in upside on property price appreciation upon sale, refinances, and supplemental loans

- Diversification offers the ability to reduce risks while offering the potential for higher returns

- Potential tax benefits for investors such as pass-through depreciation opportunities and 1031 exchanges

Chavis’ outstanding reputation offers sellers with surety of a smooth closing at the contracted purchase price. Our large roster of repeat equity investors and lenders enables us to move quickly on each transaction. If you have a property that meets our criteria, please contact us.

Ready to Get Started?

Simply login to our Investor Portal and submit your commitment.

Is this your first time investing with us? Start here.

After that, we’ll follow-up with you via email on how to verify your accreditation status, e-sign your documents, and fund so you can finalize your commitment.

Disclaimer: This investment will be filled on a first-come, first-fund basis and is open to accredited investors only. All investment information will be made available in the investor portal.

Ready to Get Started?

Simply login to our Investor Portal and submit your commitment.

Is this your first time investing with us? Start here.

After that, we’ll follow-up with you via email on how to verify your accreditation status, e-sign your documents, and fund so you can finalize your commitment.

Disclaimer: This investment will be filled on a first-come, first-fund basis and is open to accredited investors only. All investment information will be made available in the investor portal.

Still Have Questions?

Schedule a call with our Investor Relations Consultant, Shayne Whittington.